Proxima DOM enables to submit an order directly from the orderbook.

There are two ways to submit an order:

- One-click limit order submission

- DOM extended menu order submission (more order types available)

Both of them are reviwed below.

One-click limit order submission

- To open an orderbook click on New in the upper main menu of ProximaTrader Default window and select either Fixed or Dynamic DOM.

The difference between these 2 types of the orderbook is described in the Fixed VS Dynamiс orderbook section. The order submission process is the same for both orderbooks.

2. To see the market data select two options in the Exchange & Symbol dropdown menu.

- Exchange (1): The exchange you would like to view the information on the asset from.

- Symbol (2): The symbol (instrument / asset) you would like to view the order book of. The trading instrument selection process is described here.

3. Select an Account you would like to trade from.

4. Select Time in force. Find more information on this function here. The function is optional. By default, it implies GTC order execution meaning that your order remains effective indefinitely until fully executed unless cancellation is made by the trader.

5. Specify the amount of the order in the field Amount by typing and/or customising it with the arrows on the right.

6. Look at the prices displayed in the orderbook and select the one you want to conduct a trade at.

7. Left-click on the price selected.

Done! The order marked as yellow means that you submit order successfully.

Discover more about order display and the position management in DOM orders and positions management.

Extended order entry

One more way to submit an order directly from the DOM menu is Extended order entry. It enables to submit different order types:

- Limit

- Market

- StopLimit

- StopMarket

- TakeProfitLimit

- TakeProfitMarket

- Right-click at the DOM price ladder and enable Extended order entry.

- The following menu on the left will appear:

3. Specify the order size via writing an amount desired in the order size window or selecting the size from those offered below.

Note: The CLR is the option that clears the order size field.

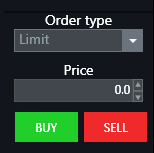

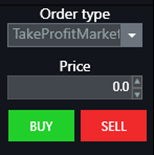

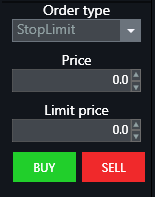

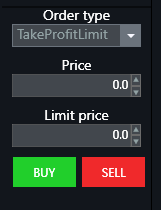

4. Select order type in Order type field:

- Limit

- Market

- StopLimit

- StopMarket

- TakeProfitLimit

- TakeProfitMarket

5. Then basing on the order selected follow the steps:

- For Market order:

Press Buy in case you are willing to go long. Press Sell in case you are willing to go short.

- For Limit order, Stop Market order, TakeProfit Market order:

- Select the price.

- Press Buy in case you are willing to go long. Press Sell in case you are willing to go short.

- For Stop Limit order, TakeProfit Limit order:

- Select the trigger price (Price).

- Select the limit price.

- Press Buy in case you are willing to go long. Press Sell in case you are willing to go short.

Discover the instructions on DOM orders and positions management and Advanced DOM functionality to know more about DOM functionality.